Paxum for Startups: Transforming the Way You Manage Finances.

Paxum for Startups: Transforming the Way You Manage Finances

Why Choose Paxum for Your Startup?

Starting a new business can be overwhelming, especially when it comes to managing finances. As a startup founder, it’s crucial to find a reliable and efficient financial management solution that can streamline your operations. That’s where Paxum comes in.

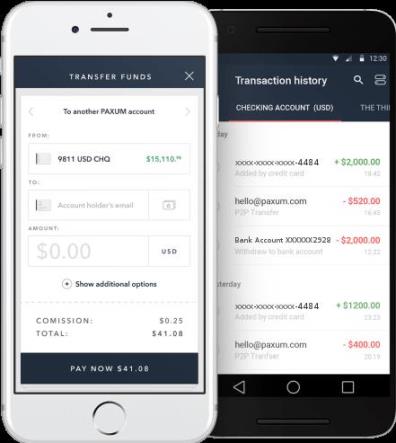

Effortless Transactions

Paxum simplifies financial transactions for startups. With just a few clicks, you can send and receive payments worldwide. Say goodbye to frustrating delays and manual paperwork. Paxum’s quick and secure platform enables you to focus on growing your business instead of worrying about financial logistics.

Global Presence

One of the standout features of Paxum is its global reach. Whether you’re collaborating with international clients or hiring remote talent, Paxum provides a seamless experience across borders. Their multi-currency accounts and localized banking options ensure that your money is accessible anytime, anywhere.

Faster Payouts

For startups operating in industries such as e-commerce or affiliate marketing, quick payouts are vital. With Paxum, you can enjoy accelerated payout processing times, saving you valuable resources and boosting your business’s efficiency. No more waiting for weeks to receive your hard-earned revenue.

Frequently Asked Questions (FAQs) About Using Paxum for Startups

1. Is Paxum safe to use for my startup?

Absolutely, Paxum prioritizes the security and privacy of its users. They employ state-of-the-art encryption technology and adhere to strict industry regulations to protect your financial data. Additionally, Paxum provides two-factor authentication and transaction alerts to keep your account safe.

2. Can I integrate Paxum with other financial platforms my startup uses?

Yes, Paxum offers seamless integrations with popular financial platforms such as PayPal and Skrill. By connecting your accounts, you can easily transfer funds between platforms, enabling efficient financial management for your startup.

3. What fees are associated with using Paxum?

Paxum has transparent and competitive pricing. While account creation and maintenance are free, there might be fees associated with certain transactions or currency conversions. It’s always recommended to review their fee structure on the Paxum website or consult their customer support for detailed information.

4. How quickly can I get started with Paxum for my startup?

Signing up for Paxum is a quick and straightforward process. You can create an account online and provide the necessary details to verify your identity. Once approved, you’ll gain access to a wide range of financial management tools tailored specifically for startups.

The Future of Financial Management for Startups Starts Here

Managing finances efficiently is a crucial aspect of startup success. Paxum provides startups with a user-friendly, secure, and globally accessible platform to manage their finances with ease. Say goodbye to traditional banking hurdles and embrace the future of financial management. Sign up for Paxum today and transform the way you handle your startup’s finances.

Remember, a comprehensive and efficient financial management solution can make a significant difference in your startup’s growth trajectory. Choose Paxum and start experiencing the transformative power of streamlined financial management.

Note: The above information is presented for informational purposes only and should not be considered financial advice. It’s always recommended to consult with a financial professional for personalized guidance.