The Art and Science of A Deep Dive into the World of Insurance Premiums: A Detailed Analysis

The Art and Science of A Deep Dive into the World of Insurance Premiums: A Detailed Analysis

Understanding Insurance Premiums

What are Insurance Premiums?

Insurance premiums are the payments you make to an insurance company in exchange for coverage. They are typically paid monthly, quarterly, or annually, depending on your policy. These premiums serve as a financial protection mechanism and vary based on several factors.

Factors Influencing Insurance Premiums

Insurance premiums are determined by various factors, including:

1. Age and gender

2. Location and environment

3. Health and lifestyle habits

4. Coverage type and level

5. Claims history

6. Vehicle type and usage (for auto insurance)

7. Credit score (for some policies)

Analyzing Insurance Premiums

Understanding Premium Calculation

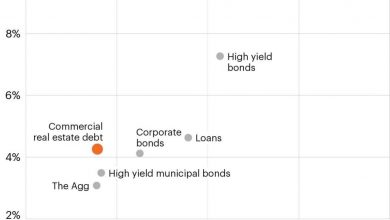

Insurance companies use complex algorithms to calculate premiums. While the exact formulas may differ, they generally consider the risk associated with insuring a particular individual or item. Actuaries assess the likelihood of a claim based on historical data, and this analysis influences premium rates.

The Art of Shopping for Insurance

To find the best insurance premiums, it’s important to shop around and compare quotes from multiple providers. Take into account the coverage, deductibles, and benefits offered by each company. Remember, the lowest premium may not always be the best option—consider the overall value and reputation of the insurer.

The Science of Negotiating Premiums

Once you’ve chosen an insurer, it’s worth negotiating your premium rate. By demonstrating your loyalty, safe driving habits, and low-risk lifestyle, you can potentially secure a lower premium. Additionally, you may qualify for discounts by bundling multiple insurance policies or having safety features installed.

Frequently Asked Questions (FAQs)

Q: Can I lower my insurance premiums?

A: Yes, there are several ways to potentially lower insurance premiums. You can opt for higher deductibles, maintain a good credit score, bundle multiple policies, and take advantage of discounts for safety features or safe driving habits.

Q: What if I can’t afford my insurance premiums?

A: If you’re struggling to pay your insurance premiums, reach out to your insurance company. They may be able to offer a lower premium plan, adjust the payment schedule, or suggest other options to help make insurance more affordable for you.

Q: Will my insurance premium increase after making a claim?

A: Making a claim can affect your insurance premium. While some companies may increase your premium after a claim, others may offer accident forgiveness or allow you to maintain your current premium if it’s your first claim.

Conclusion

Understanding insurance premiums requires a mix of art and science. By analyzing the various factors that influence premiums and implementing effective strategies to reduce them, you can ensure that you’re getting the best possible coverage at an affordable price. Remember to shop around, compare quotes, and negotiate with your insurer to find the most suitable premiums for your needs.