The Impact of Cryptocurrency on the Stock Market

The Impact of Cryptocurrency on the Stock Market

Introduction

Cryptocurrency has emerged as a disruptive force in the financial world, challenging traditional systems and opening up new opportunities for investors. One area where the impact of cryptocurrency is particularly noteworthy is the stock market. In this blog post, we will explore how cryptocurrencies are influencing the stock market and what it means for investors.

Understanding the Relationship

Are cryptocurrencies and stocks the same?

No, cryptocurrencies and stocks are not the same. Stocks represent ownership in a company, while cryptocurrencies are digital assets that utilize blockchain technology for security and transactions.

How does cryptocurrency impact stock market volatility?

Cryptocurrencies are known for their high volatility, and when they experience significant price movements, it can have a spillover effect on the stock market. Investors who are active in both markets may adjust their strategies based on cryptocurrency price movements, leading to increased stock market volatility.

Positive Impacts of Cryptocurrency on the Stock Market

Increased investment opportunities

Cryptocurrencies have opened up new investment opportunities for traders and investors. Many companies have embraced the concept of blockchain technology and have entered the cryptocurrency space. As a result, investors can now diversify their portfolios by including both stocks and cryptocurrencies.

Greater liquidity

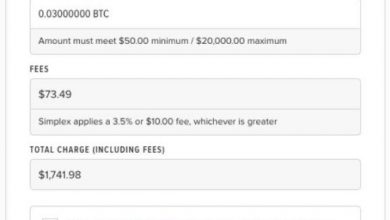

Cryptocurrency exchanges operate 24/7, providing greater liquidity compared to traditional stock markets that have fixed trading hours. This liquidity can spill over into the stock market, enhancing trading volumes and price efficiency.

Technological innovation

The emergence of cryptocurrencies has forced traditional financial institutions to adapt and integrate blockchain technology into their operations. This technological innovation has the potential to streamline stock market processes such as settlement and clearing, making transactions faster, more efficient, and secure.

Negative Impacts of Cryptocurrency on the Stock Market

Increased market uncertainty

Cryptocurrencies are still relatively new and highly speculative assets, which can introduce significant uncertainty into the stock market. Sudden price fluctuations and regulatory uncertainties in the cryptocurrency space can make investors more cautious, leading to increased market volatility.

Regulatory challenges

The regulatory landscape for cryptocurrencies is still evolving, and governments worldwide are exploring ways to regulate and monitor the industry. This regulatory uncertainty can negatively impact the stock market, as investors may shy away from companies associated with cryptocurrencies due to concerns about compliance and regulatory risks.

Conclusion

The impact of cryptocurrency on the stock market should not be underestimated. While cryptocurrencies bring exciting new opportunities and innovation to the financial world, their volatility and regulatory challenges can also introduce risks. Investors must carefully consider their risk tolerance and stay informed about both cryptocurrency and stock market developments to navigate these changing dynamics successfully.

Frequently Asked Questions (FAQs)

1. Should I invest in cryptocurrencies or stocks?

The decision to invest in cryptocurrencies or stocks depends on your risk appetite and investment goals. Cryptocurrencies tend to be more volatile and speculative, while stocks offer more traditional investment opportunities. It is recommended to diversify your portfolio to mitigate risks.

2. How can I stay informed about cryptocurrency and stock market developments?

To stay informed, regularly follow reputable financial news sources, read market analysis, and consider joining online communities or forums dedicated to cryptocurrencies and stock investments. Keeping an eye on reputable financial advisors and monitoring market trends can also help you make informed investment decisions.

3. Are cryptocurrencies regulated?

The regulatory landscape for cryptocurrencies varies across countries. While some countries have implemented regulations, others are still in the process of developing a framework. It is crucial to understand the regulatory environment in your jurisdiction before investing in cryptocurrencies.

By providing answers to common questions and discussing the impact of cryptocurrency on the stock market, this blog post aims to equip readers with valuable information for informed decision-making. Remember, always conduct thorough research and seek professional advice before making any investment decisions.